By Patricia González

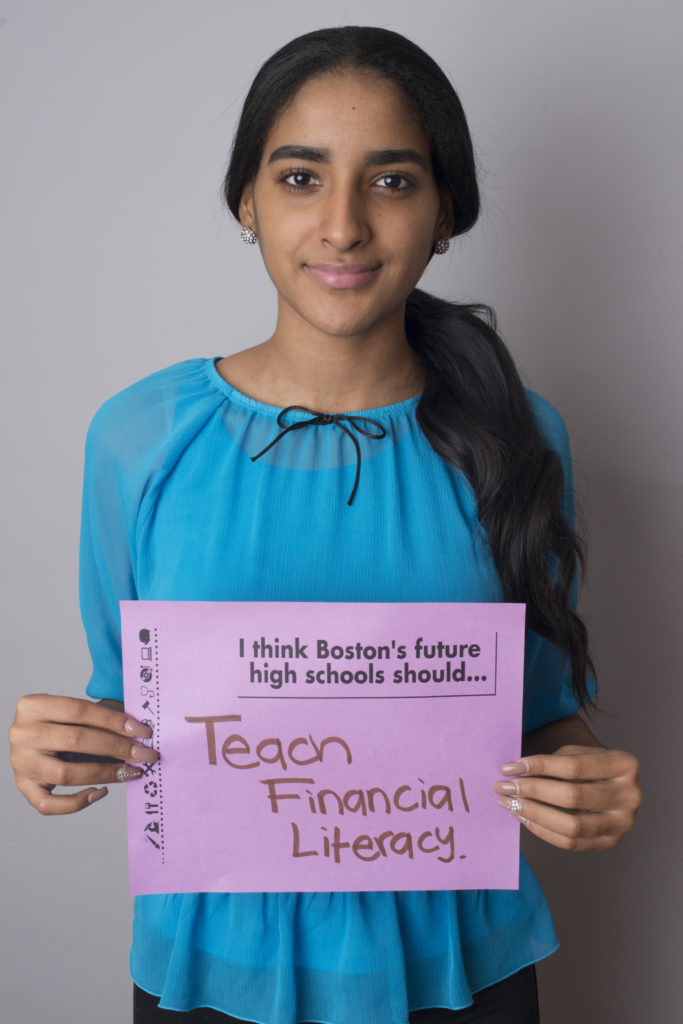

High school students are not given the opportunity in school or in their communities to learn about financial literacy. I personally feel like I don’t have a strong understanding about financial literacy. Is it because I don’t like math? Or maybe it’s because I am not learning the stuff that I am supposed to be learning?

This is something complicated that needs to be fixed. Students don’t have classes related to financial literacy in schools, and therefore they end up graduating without knowing how to balance a checkbook, budget, or apply for loans. Because of these problems the result is that many of us end up in poverty, debt, and with poor health care. Classes shouldn’t only be based on history, chemistry, or math equations. Students that go to college after high school do not feel prepared when it comes to dealing with money and finances. Therefore financial literacy courses are what we need.

I spoke to Bob Giannino, CEO of uAspire, an organization dedicated to helping students navigate the financial challenges of going to college.

Patricia: What is financial literacy and why is it important?

Bob: I would define financial literacy as having a strong understanding of how to manage your life within your financial constraints and capacities and having a healthy relationship with money, and the role that money plays in our lives. It is very easy for bad financial situations to hold us back and to hold our children back, so I think it’s important to the world that we have a firm grasp on what it means to live within our means, how to manage money well, how to save money for rainy days.

Patricia: How do you help students become financially literate?

Bob: We use college financing as an opportunity to have conversations with students and families about budgeting, saving, making really good financial decisions and the implications of financial decisions on a young person’s future. We try to do it in a very respectful way. We’re not here to lecture parents and families about decisions that they’ve made in the past but we feel that it’s really important, when students and families are making college financing decisions, to be very aware of the macro, larger picture financial aspects of that decision. You can’t make the decision about how to pay for college in a vacuum, right?

Paying for college will probably be the second-largest financial decision that most people will make in their life, second to buying a house. It’s often going to cost people twenty or thirty thousand dollars. And it can have really harmful, long term effects on a young person and on a family if they don’t make the right decision. For example, when you take out a student loan those student loans can never be forgiven.

Patricia: If you could design the ideal financial literacy curriculum for high school, what would it look like?

Bob: I would start very early in high school and keep it up [through] twelfth grade. It would be connected to things that are immediately relevant to those students’ lives. I’m not talking about something like buying a house in fifteen years but things that are right in front of them like interest and how saving dollars can grow over time. There would be an element of investing and what it means to invest smartly. I’d talk about “nice-to-have things” versus “need-to-have things” when it comes to making spending decisions and prioritizing. It would have elements of negotiating as it applies to employment and wages. It would distinguish between good and bad kinds of borrowing and loans.

You must be logged in to post a comment.